Bondholders may have to wait until 2032 for Beximco Sukuk principal

The maturity period of the Beximco Green Sukuk has been proposed

to be extended by up to six years to 2032, as repayment of principal to

bondholders has become uncertain amid changes in the political climate.

The recommendation came from a 21-member working committee

formed by the trustee, the Investment Corporation of Bangladesh (ICB), based on

opinions from bondholders-mostly banks-and following visits to the solar plants

financed with proceeds from the Shariah-compliant bonds.

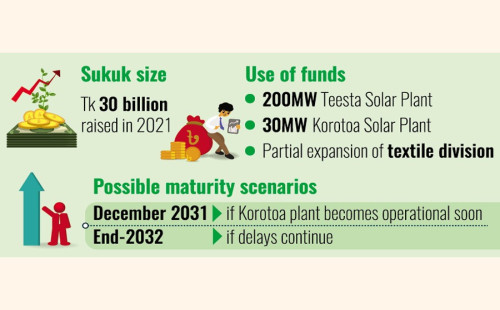

Beximco raised Tk 30 billion through the sukuk in 2021 to build

the 200 MW Teesta Solar Plant and the 30 MW Korotoa Solar Plant, and to partly

expand its textile division.

In a report submitted to the central bank last month, the

committee said the maturity period could be extended until December 2031 if the

Korotoa Solar Plant becomes operational in the near future. Otherwise, the

sukuk's maturity could be set for the end of 2032.

"We held meetings with experts and bondholders. We made

separate proposals considering the overall situation," said Md Nurul Huda,

chief of the working committee.

The final decision on extending the bond's tenure now rests with

the Bangladesh Bank, said Mr Huda, who is also a deputy managing director of

ICB.

Debate over base rate

During meetings with the working committee, bondholders demanded

that the sukuk's base rate be raised from the existing 9 per cent to as high as

11 per cent.

The sukuk's current structure offers a 9 per cent base rate plus

an additional profit margin linked to Beximco's cash dividends.

According to the prospectus, if the company's cash dividends for

any year exceed 9 per cent, sukuk holders are entitled to additional payments.

One-tenth of any excess dividend paid to shareholders over the sukuk base rate

is added to the sukuk's return.

Under this arrangement, higher dividends for shareholders would

translate into higher returns for sukuk investors.

However, following the political changeover in August last year,

Beximco reported a loss of Tk 358 million in FY24, compared with a profit of Tk

7.1 billion in the previous year, leaving the company unable to declare

dividends.

Experts advised that the base rate of the Shariah-compliant

instrument should not exceed the deposit rates offered by Islamic banks, most of

which currently stand at around 9 per cent.

As settlement of the sukuk at maturity in December 2026 is

already facing difficulties, they cautioned that increasing the base rate could

trigger further financial stress.

The working committee included these observations in its report

to the central bank.

Repayment to bondholders

At present, Beximco requires Tk 1.26 billion every six months to

meet its repayment obligations to bondholders.

Of the two solar projects financed by the sukuk, the Teesta

Solar Plant entered full commercial operation in January 2023, while the

Korotoa Solar Plant has yet to begin generating electricity.

The company currently services its obligations using monthly

revenue of about Tk 500 million received from the Bangladesh Power Development

Board (BPDB) for electricity supplied from the Teesta plant.

Beximco has a 20-year power purchase agreement with the BPDB,

running until 2041.

The trustee said it receives around Tk 3 billion every six

months, of which a portion is retained for repayment of the bond principal.

ICB also said the issuer is seeking new investors to complete

the Korotoa Solar Plant.

Explaining the funding shortfall for the second project, the

trustee noted that the company assessed capital requirements in 2019, when the dollar-taka

exchange rate stood at around Tk 86. The exchange rate rose sharply by the time

construction began, increasing project costs.

Conversion from bonds to shares

Meanwhile, investors have shown little interest in exercising

the option to convert sukuk holdings into Beximco shares.

Under the prospectus, the Shariah-compliant bonds allow annual

conversion of up to 20 per cent of an investor's holdings into shares.

The company is currently burdened with heavy bank loans that it

has been unable to repay.

Before its weakened financial position became evident under the

new political landscape, sukuk units worth only Tk 1,907.60 million were

converted into shares.

Against this backdrop, the central bank in July asked ICB to

submit a revised plan for the settlement of the Beximco Green Sukuk.