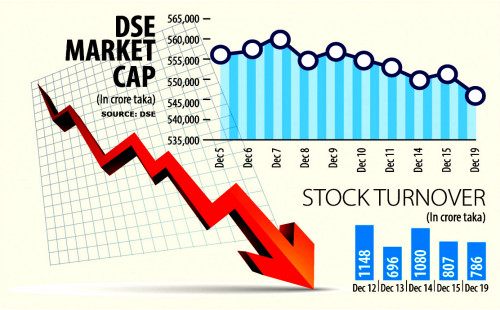

Stocks nosedive on BB-BSEC tension

Dhaka stocks took a steep dive

yesterday as investors continue to suffer from a confidence crisis amid growing

tension between Bangladesh Bank and the Bangladesh Securities and Exchange

Commission (BSEC).

The DSEX, the benchmark index of the

Dhaka Stock Exchange (DSE), nosedived 84 points, or 1.23 per cent, to 6,873.

Turnover, an important indicator of

the market, stood at Tk 786 crore, down 2 per cent from Tk 807 crore the day

before.

"Investors are suffering from a

confidence crisis due to the deteriorating situation between two regulators

regarding some issues," said a top official of a merchant bank preferring

anonymity.

A few weeks back, the BSEC ordered

all listed companies, including banks and non-bank financial institutions

(NBFIs), to deposit their undistributed dividends to the stock market

stabilisation fund.

It also allowed banks and NBFIs to

declare dividends from the current year's profits despite having cumulative

losses. However, the central bank ordered them to disregard BSEC's orders.

The dispute arose when, after a

meeting with Bangladesh Bank, the BSEC said the central bank would change its

bank exposure policy by allowing cost-based exposure instead of market value.

However, the central bank refuted

this, saying no such decision was not taken at the meeting.

In such a situation, the fight took

a new turn as the BSEC curtailed banks' power to cancel payments to perpetual

bond holders.

In protest, Bangladesh Bank a sent

letter to lenders in the country, saying the BSEC's condition is at odds with

central bank guidelines on risk-based capital adequacy.

Such a tussle between the two

regulators is badly affecting the market, the merchant banker added.

Eastern Insurance topped the gainers

list yesterday, rising 10 per cent, followed by Asia Insurance, Bangladesh

National Insurance, Khan Brothers PP Woven Bag, and Shurwid Industries.

Stocks of Beximco Ltd traded the

most, worth Tk 73 crore, followed by One Bank, Sonali Paper, Fortune Shoes, and

Active Fine Chemicals.

SS Steel shed the most, dropping

8.84 per cent, followed by Aramit Cement, Fortune Shoes, Beach Hatchery, and

Aziz Pipes.

At the DSE, 87 stocks advanced, 266

fell and 25 remained same.

The prime bourse suffered yet

another setback as investors' mounted sell-offs in all major sectors, including

banks and financial institutions, International Leasing Securities said in its

daily market review.

The DSEX plummeted 85 points as the

current market scenario failed to offer any clear indication of recovery for

investors.

However, several small-caps from

various sectors and the general insurance sector remain in the investors' good

grace, it added.

Among major sectors, based on market

capitalization, financial institutions the dropped most followed by food and

allied, and bank.

Investor activity was mostly

concentrated on the bank, general insurance and miscellaneous sectors.

The Chittagong Stock Exchange (CSE)

also fell yesterday as the CASPI, the main index of the port city bourse,

dropped 336 points, or 1.67 per cent, to 19,738.

Among 285 traded stocks, 63 rose,

204 fell and 18 remained unchanged.

Source: The Daily Star

.png)