Banks required to submit daily foreign currency monitoring reports to BB

The regulator brings operations of banks' offshore

banking units (OBU) under its close watch following a steep rise in demand for

foreign-currency loans, particularly in private sector.

As part of the regulatory move, sources say, the

Bangladesh Bank (BB) has included the OBU operations in a new head of daily

foreign-currency-monitoring report.

The daily-reporting obligation is scheduled to take effect finally from March 21.

A reporting format has already been released in this

connection to collect information on assets and liabilities of OBU operations

along with other relevant data relating to overall foreign-exchange exposure

from scheduled banks, officials say.

Scheduled banks have already been asked to provide

daily exchange position including OBU operations using new rationalized input

template (RIT) on trial basis from February 16, they add.

The BB officials, however, say the daily monitoring

report will help them know about real situation on the country's

foreign-exchange (forex) market.

Besides, the central bank wants to know about

compliance with rules and regulations of OBU operations by the operators

through using the daily monitoring report.

"Actually, we want to know about latest limit of

OBU fund mobilization from domestic sources as well as the size of assets and

liabilities of offshore banking," a BB senior official told the FE.

Earlier on January 31 last calendar year, the central

bank had asked the banks to bring down the limit of OBU fund mobilization from

domestic sources to 30 per cent of their total regulatory capital by December

31, 2021.

Besides, at the close of business on any day, value of

offshore-banking assets in Bangladesh shall not be less than 75 per cent of the

liabilities of offshore banking, according to notification issued by the

central bank on February 25, 2019.

The central bank had brought the offshore-banking operations

in Bangladesh under regulation by issuing the policy in 2019.

In the past, the central bank was not empowered fully

to monitor and supervise the OBU operations closely due to legal constraints.

"We've included the OBU operations in our new

reporting format to monitor the inflow and outflow of foreign currency through

offshore banking properly," another central banker told the FE while

explaining main objective of the latest BB moves towards regulating the forex

market that remains heated of late with exchange rate of the US dollar with the

local currency rising.

Meanwhile, demand for foreign-currency loans through

OBUs of banks has increased gradually despite the capping of lending rate at

maximum 9.0 per cent by the central bank.

"Short-term foreign-currency credits are still

cheaper than local- currency loans mainly due to lower interest rate on such

loans," a senior executive of a leading private commercial bank (PCB) told

the FE Thursday while explaining the uptrend in such loans.

Under the BB's latest policy, the banks are now

allowed to fix the interest rates on buyers/suppliers' credit at six-month

LIBOR (London Inter-bank Offered Rate) plus maximum 3.50 per cent.

Effective interest rate on foreign-currency credit is

now around 4.0 per cent, according to the private banker.

The businessmen are now allowed to avail such credits

to import capital machinery and industrial raw materials.

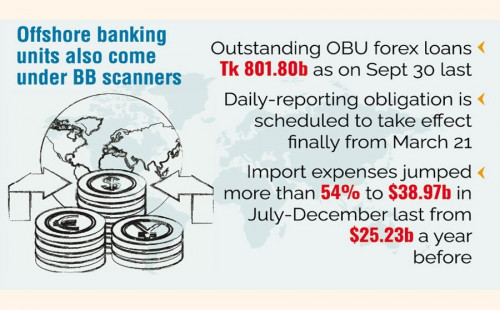

Meanwhile, outstanding amount of OBU loans that were

provided in terms of foreign currency rose to Tk 801.80 billion as on September

30 last calendar year from Tk 630 billion as on December 31, 2020, according to

the central bank's latest statistics.

The outstanding amount of OBU loans were Tk 730

billion as on June 30, 2021.

Senior bankers, however, say such foreign-currency

loans have increased significantly in recent months following higher import-

payment obligations on the economy.

Bangladesh's import expenses jumped more than 54 per

cent to $38.97 billion in July-December period of the current fiscal year (FY),

2021-22, from $25.23 billion in the same period a year before.

Higher prices of essential commodities, including

petroleum products, on the global market have also pushed up the country's

import payments during the period under review, they explain.

Actually, Bangladesh's foreign trade covering import

and export has increased significantly during the period under review on the

back of gradually reopening economic activities, both domestic and global,

after more than one year of slump mainly due to the Covid-19 pandemic.

.png)